Salaries, Wages and Expenses on a Balance Sheet Chron com

Content

For people over the age of 65, it comes primarily from pensions, social security and/or investments. Income can mean the money people receive for the work they do in the form of wages or salaries, or the revenues of companies . GNI is the total domestic and foreign output claimed by residents of a country. Consult with accounting and/or tax professionals for information that’s specific to your business. Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

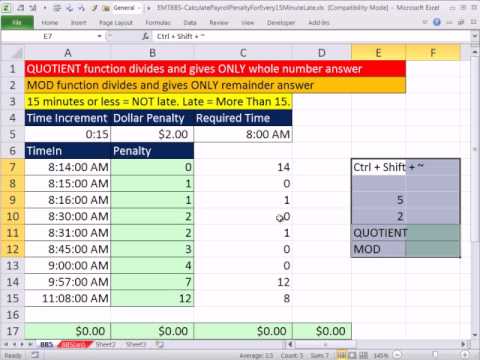

Salary is coming to be seen as part of a “total rewards” system which includes bonuses, incentive pay, commissions, benefits and perquisites , and various other tools which help employers link rewards to an employee’s measured performance. They are likely to include at least all expenses, which are not possible to get higher tax deductions through the personal income tax system. A non exempt employee is one who qualifies to earn at least minimum wage and receive overtime under https://online-accounting.net/ the federal Fair Labor Standards Act . Wage expenses vary from one period to the next, depending on the number of business days in the period and the amount of overtime to be paid. Business days vary from month to month and may be affected by the number of holidays during the period. Wage expenses are variable costs and are recorded on the income statement. As an example, assume that a manufacturing company incurred a wage expense of $200,000 for the fiscal year 2020.

Salaries, Wages and Expenses

The selection process is rigorous and thereafter the process initiation speaks of total dedication to the company. In India, salaries are generally paid on the last working day of the month (Government, Public sector departments, Multi-national organisations as well as majority of other private sector companies). According to the Payment of Wages Act, if a company has less than 1,000 Employees, salary is paid by the 7th of every month. If a company has more than 1,000 Employees, salary is paid by the 10th of every month.

What is salaries and wages expense in accounting?

What Is a Wage Expense? A wage expense is the cost incurred by companies to pay hourly employees. This line item may also include payroll taxes and benefits paid to employees. A wage expense may be recorded as a line item in the expense portion of the income statement. This is a type of variable cost.

If your business is healthy and successful, the amounts you spend on salaries, wages and operating expenses add value to your bottom line. Direct labor included in cost of goods sold should go into creating products that you can sell for more than the cost of the materials and payroll that went into them. These sales typically translate into assets that improve your company’s net worth. Represents the earnings of non-exempt personnel performing clerical duties for the support of general departmental functions. Employees charged to this G/L account should have position titles in the CLERICAL group of job families . For companies that produce goods (i.e., manufacturing companies), a portion of their wage expense may be aggregated into costs of goods sold on the income statement.

Summary: Expense Definition

Overall, individuals who are risk-averse (e.g., worried about appearing ungrateful for the job offer) tended to avoid salary negotiations or use very weak approaches to the negotiation process. On the contrary, those who were more risk-tolerant engaged in negotiations more frequently and demonstrated superior outcomes. Individuals who approached the negotiation as a distributive problem (i.e. viewing the a higher salary as a win for him/her and a loss to the employer) ended up with an increased salary, but lower rate of satisfaction upon completion. Since “dollarisation” Zimbabwe has been moving toward a more informal sector and these are paid in ‘brown envelopes’. Median monthly earnings of white and Indian/Asian population were substantially higher than the median monthly earnings of their coloured and black African counterparts.

- Salary expenses differ from wage expenses as they are not hourly but rather quoted annually.

- The number of wage expenses recorded on an accrual basis is the total amount of money earned by employees over the reporting period.

- For the most part, the more your business earns, reflected by the bottom line of your profit and loss statement, the greater the value of the assets that will be reflected on your balance sheet.

- Depending on the function performed by the salaried employee, Salaries Expense could be classified as an administrative expense or as a selling expense.

Under cash accounting, wage expenses are reported only when the worker is paid. Notwithstanding the foregoing or anything to the contrary herein, Company Expenses shall not include any HighCape Expenses. The relationship between the sums you earn on your income statement and the assets and liabilities shown on your balance sheet are not direct, however.

What Is a Wage Expense?

This is skewed downwards by the large number of government employees whose average salary is around there. At the top end salaries salaries expense definition and meaning are quite competitive and this is to be able to attract the right skills though the cost of living is high so it balances this out.

Often operating expenses receive the most scrutiny from a company, as these types of costs may be less fixed than their non-operating expenses, manufacturing costs and capital expenditures. Certain nations, including Italy, Denmark, and Sweden, have no legal minimum wage. As there’s no legal protection on minimum salary, it pays to have insight on average salaries to ensure you’re paid competitively. Gross income is a strong indicator of the rewards offered for a certain role, but the term only applies to financial benefits. All elements combined—including your base salary, gross income, and other bonuses—create what is known as a compensation package.

Remember to account for any overtime if the employee is nonexempt and works over 40 hours in the workweek. You must claim the tax deduction for salaries, wages, commissions, and bonuses in the year they’re paid to your employees if your business uses the cash method of accounting. You would claim the deduction for the year in which the obligation to pay is established and when the services are actually performed if you use the accrual method. Represents the earnings of non-exempt personnel performing service duties for the exclusive support of the Instruction/Training/Departmental Research functions. Represents the earnings of non-exempt personnel performing technical duties for the exclusive support of the Instruction/Training/Departmental Research functions.

Any time you make an investment in your business, it brings benefits and burdens. Conversely, too few investments in your company can stunt your company’s growth. Business expense advantages might include infusing more resources into the company.

)